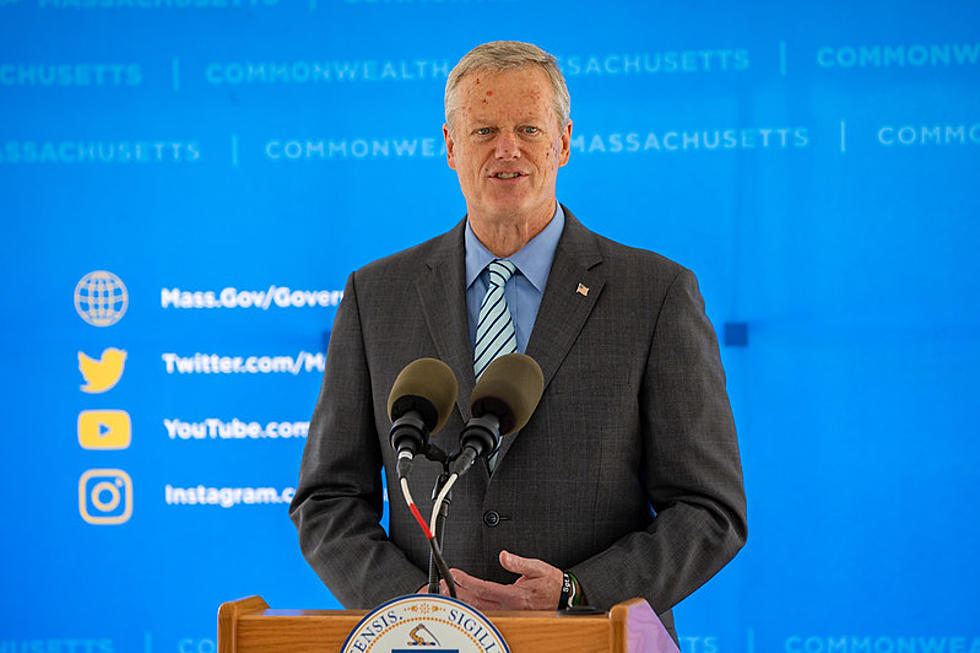

Gov. Charlie Baker Has Filed A 2021 Massachusetts Supplemental Budget

Governor Charlie Baker filed a final Fiscal Year 2021 supplemental budget proposal today that aims to improve Massachusetts’ economic competitiveness as the Commonwealth continues to recover from the COVID-19 pandemic.

According to a news release from the Governor's office, the $1.568 billion supplemental budget would provide $1 billion in unemployment insurance relief for employers, support greater resources for local charities and nonprofits, and ensure that small businesses do not bear a tax burden for assistance received through pandemic relief programs. The legislation relies on a FY21 surplus of approximately $5 billion and would also make critical investments in housing, human services, and education.

Thanks to careful management of the Commonwealth’s tax revenues and strong economic activity, Massachusetts has an unprecedented surplus at the close of Fiscal Year 2021, and this legislation ensures those resources are put to work to support local economies and small businesses... Our proposal to provide employers with unemployment insurance relief is fiscally responsible and would provide much-needed support for businesses and workers across the Commonwealth. By combining this bill with our $2.9 billion plan to spend a portion of Massachusetts’ federal funds on urgent priorities like homeownership, environmental infrastructure, and job training, the Commonwealth has an opportunity to leverage significant resources to promote further economic growth and support our hardest-hit communities. ~ Governor Charlie Baker

The Administration’s supplemental budget proposes dedicating $1 billion of Massachusetts’ FY21 surplus toward the Unemployment Insurance Trust Fund. This affordable proposal would help stabilize the UI Trust Fund and lessen employers’ future UI obligations. The legislation also includes language to make the federal Paycheck Protection Program loans, Economic Injury Disaster Loan advances, Shuttered Venue Operators grants, Restaurant Revitalization Fund grants, and state MGCC grants nontaxable for all Massachusetts recipients, consistent with federal tax treatment.

The bill is also proposing to finally implement the income tax charitable deduction, a measure that was first approved by voters nearly twenty years ago. Given the Commonwealth’s strong fiscal situation, the proposal is fiscally responsible and would support greater resources for the local charities and non-profits who supported vulnerable populations through the pandemic.

50 Most Popular Chain Restaurants in America

What Are the Signature Drinks From Every State?

CHECK IT OUT: See the 100 most popular brands in America

More From WBEC AM